The allure of generating passive income in the cryptocurrency market has led many to explore automated trading solutions, particularly crypto arbitrage bots. These software programs are designed to automatically identify and execute crypto arbitrage trades across multiple exchanges, promising a hands-off approach to profiting from price discrepancies. But is using crypto arbitrage bots truly a reliable path to passive income?

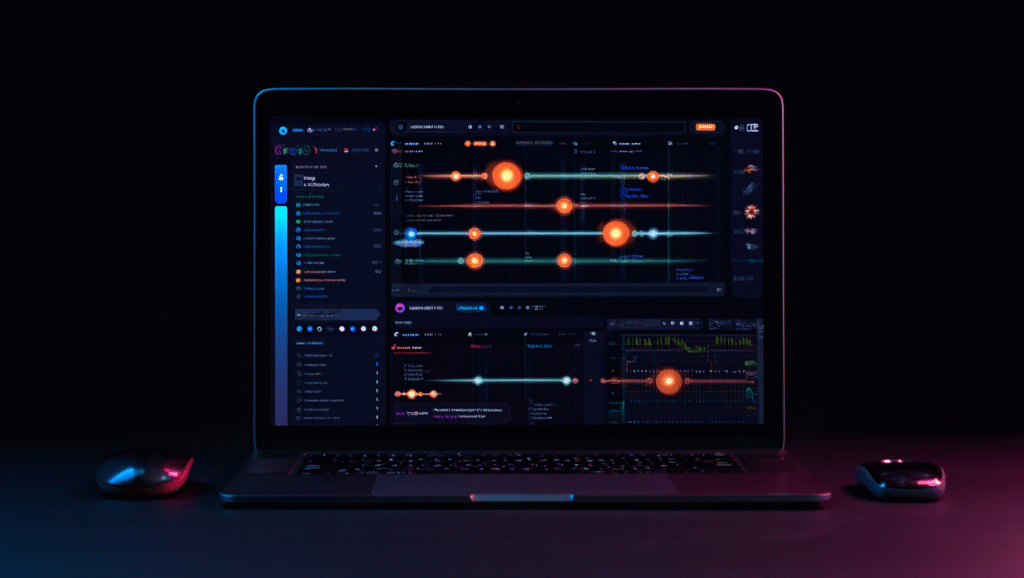

Crypto arbitrage bots work by continuously monitoring the prices of various cryptocurrencies on different exchanges. When the bot detects a significant price difference for the same asset, it automatically buys on the cheaper exchange and sells on the more expensive one, aiming to capture the profit margin. This process can occur within seconds, capitalizing on fleeting opportunities that human traders might miss.

The primary appeal of crypto arbitrage bots is the potential for passive income. Once set up and configured correctly, these bots can theoretically operate 24/7, executing trades without requiring constant manual intervention. This can be particularly attractive to individuals who lack the time or expertise for active crypto trading.

However, the reality of using crypto arbitrage bots for passive income is often more complex than it appears. While the concept is straightforward, several factors can significantly impact the profitability and reliability of these automated systems.

One crucial factor is the sophistication of the bot itself. A well-designed bot needs to be able to execute trades quickly and efficiently, handle exchange APIs reliably, and account for transaction fees and withdrawal limits. Free or low-cost bots may lack the advanced features and robust infrastructure necessary to compete in the increasingly efficient crypto arbitrage market.

Furthermore, the profitability of crypto arbitrage opportunities has decreased significantly over time due to increased market efficiency and the prevalence of other arbitrage bots. The price differences between exchanges are often small and short-lived, requiring bots with very low latency and minimal transaction costs to be profitable.

Another important consideration is the risk associated with using crypto arbitrage bots. These bots require access to your exchange accounts, which raises security concerns. Choosing reputable bot providers and implementing strong security measures is essential to protect your funds. Additionally, technical glitches, API issues, or unexpected market volatility can lead to losses, even with automated systems.

Moreover, the “passive” aspect of income generation through crypto arbitrage bots often requires initial setup, ongoing monitoring, and periodic adjustments. Market conditions and exchange fees can change, necessitating updates to the bot’s configuration and strategies.

While crypto arbitrage bots can automate the process of identifying and executing arbitrage trades, they are not a guaranteed path to effortless passive income. Success depends on factors such as the quality of the bot, market conditions, exchange fees, and the user’s ability to configure and manage the system effectively. Thorough research, careful selection of a bot provider, and a realistic understanding of the potential risks and rewards are crucial before relying on these automated tools for generating passive income through trading crypto.